When you invest in stock, you buy ownership shares in a company—also known as equity shares.

Your return on investment, or what you get back in relation to what you put in, depends on the success or failure of that company. If the company does well and makes money from the products or services it sells, you expect to benefit from that success.

There are two main ways to make money with stocks:

-Dividends.When publicly owned companies are profitable, they can choose to distribute some of those earnings to shareholders by paying a dividend. You can either take the dividends in cash or reinvest them to purchase more shares in the company. Many retired investors focus on stocks that generate regular dividend income to replace income they no longer receive from their jobs. Stocks that pay a higher than average dividend are sometimes referred to as “income stocks.”

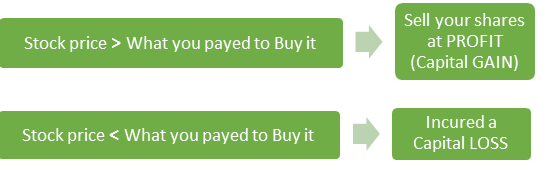

-Capital gains. Stocks are bought and sold constantly throughout each trading day, and their prices change all the time.

Both dividends and capital gains depend on the fortunes of the company—dividends as a result of the company’s earnings and capital gains based on investor demand for the stock. Demand normally reflects the prospects for the company’s future performance.

Strong demand—the result of many investors wanting to buy a particular stock—tends to result in an increase in the stock’s share price. On the other hand, if the company isn’t profitable or if investors are selling rather than buying its stock, your shares may be worth less than you paid for them.

The performance of an individual stock is also affected by what’s happening in the stock market in general, which is in turn affected by the economy as a whole.

>>Example: If interest rates go up and you think you can make more money with bonds than you can with stock, you might sell off stock and use that money to buy bonds. If many investors feel the same way, the stock market as a whole is likely to drop in value, which in turn may affect the value of the investments you hold.

Other factors, such as political uncertainty at home or abroad, energy or weather problems, or soaring corporate profits, also influence market performance.

However—and this is an important element of investing—at a certain point, stock prices will be low enough to attract investors again. If you and others begin to buy, stock prices tend to rise, offering the potential for making a profit. That expectation may breathe new life into the stock market as more people invest.

This cyclical pattern—specifically, the pattern of strength and weakness in the stock market and the majority of stocks that trade in the stock market—recurs continually, though the schedule isn’t predictable. Sometimes, the market moves from strength to weakness and back to strength in only a few months. Other times, this movement, which is known as a full market cycle, takes years.

At the same time that the stock market is experiencing ups and downs, the bond market is fluctuating as well. That’s why asset allocation, or including different types of investments in your portfolio, is such an important strategy: In many cases, the bond market is up when the stock market is down and vice versa.

Your goal as an investor is to be invested in several categories of investments at the same time, so that some of your money will be in the category that’s doing well at any given time.