By definition, a derivative is an instrument whose value derives from an underlying asset and is dependent on the value of the same underlying asset, which can be a commodity, a security or even a currency.

This instrument is a contract between two or more parties based on the underlying asset or multiple assets. You can track its value by tracking the value of the underlying asset itself.

Derivatives are also considered to have characteristics that enable them to be used as hedging tools, thus reducing the risk faced by organizations and individuals.

Below is the different structure of derivatives:

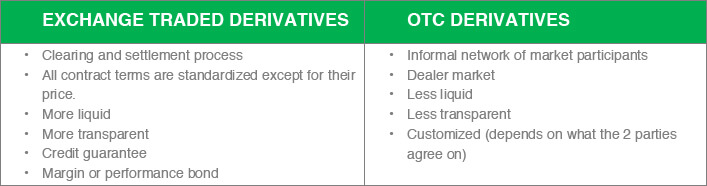

> Exchange Traded Derivatives:

They are standardized derivative contracts (e.g. future contracts and options) that are traded on an organized futures exchange. They require payment of an initial deposit or margin settled through a clearinghouse.

> Over-The-Counter (OTC) Derivatives:

OTC is a market where derivatives are directly negotiated and traded privately between two parties without the need for a third party intermediary. Products traded OTC are swaps, forward rates agreements, exotic options and other exotic derivatives.

The following portrays the main specifications and differences between the two types of markets: