Calculating your monthly cash flow will help you evaluate your present financial status, so you know where you stand financially as you prepare to invest.

> Step 1: Look at your monthly net income (the money you take home every month after taxes). This includes your salary and other steady and reliable sources of income, such as income from a second job, child support or alimony that you receive, or social security. If you already own some investments, you may be receiving dividend or interest payments; factor that amount into income, too.

> Step 2: Calculate your average monthly expenses. These include your rent or mortgage, car lease or loan, personal loan, credit card and child support or alimony payments. Also include money for groceries, utilities, transportation and insurance. Don’t forget money that you spend on items that are “discretionary”, rather than necessary.

> Step 3: Average your actual expenses over a three month period to come up with a reliable monthly estimate for your total expenses.

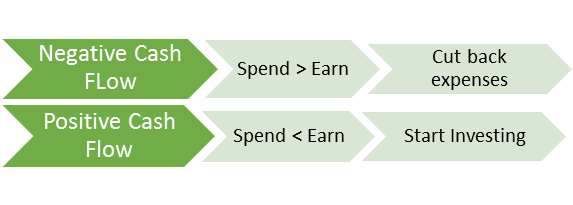

> Step 4: Subtract your monthly expense figure from your monthly net income to determine your leftover cash supply.

To invest, your net income must exceed your expenses—with some to spare. If this is not the case, look for expenses you could eliminate or reduce. Maybe some of your discretionary expenses are luxuries that you could give up. Perhaps a debt refinancing or consolidation could reduce your monthly payments. A financial professional may be able to help you with these matters.