To better understand bonds and bond funds start by familiarizing yourself with some basic concepts, starting with what a bond is. You’ll also learn about bond maturity, coupon rates and how bonds are priced.

When you invest in bonds and bond mutual funds, you face the risk that your investment might lose money, especially if you bought an individual bond and want or need to sell it before it matures. And bond mutual fund prices can fluctuate, just as stock mutual funds do. Risk will also vary depending on the type of bond you own.

WHAT IS A BOND?

A bond is a loan that an investor makes to a corporation, government, or other organization. Consequently, bonds are sometimes referred to as debt securities.

Since bond issuers know you aren’t going to lend your hard-earned money without compensation, the issuer of the bond (the borrower) enters into a legal agreement to pay you (the bondholder) interest. The bond issuer also agrees to repay you the original sum loaned at the bond’s maturity date, though certain conditions, such as a bond being called, may cause repayment to be made earlier.

The vast majority of bonds have a set maturity date—a specific date when the bond must be paid back at its face value, called par value. Bonds are called fixed-income securities because many pay you interest based on a regular, predetermined interest rate—also called a coupon rate—that is set when the bond is issued. Similarly, the term “bond market” is often used interchangeably with “fixed income market.”

BOND MATURITY

A bond’s term, or years to maturity, is usually set when it is issued. Bond maturities can range from one day to 100 years, but the majority of bond maturities range from one to 30 years. Bonds are often referred to as being short-, medium- or long-term. Generally, a bond that matures in one to three years is referred to as a short-term bond. Medium- or intermediate-term bonds are generally those that mature in four to 10 years, and long-term bonds are those with maturities greater than 10 years. The borrower fulfils its debt obligation typically when the bond reaches its maturity date, and the final interest payment and the original sum you loaned (the principal) are paid to you.

CALLABLE BONDS

Not all bonds reach maturity, even if you want them to. Callable bonds are common. They allow the issuer to retire a bond before it matures. Call provisions are outlined in the bond’s prospectus (or offering statement or circular) and the indenture—both are documents that explain a bond’s terms and conditions. While firms are not formally required to document all call provision terms on the customer’s confirmation statement, many do so. (When you buy municipal securities, firms are required to provide more call information on the customer confirmation than you will see for other types of debt securities.)

You usually receive some call protection for a period of the bond’s life (for example, the first three years after the bond is issued). This means that the bond cannot be called before a specified date. After that, the bond’s issuer can redeem that bond on the predetermined call date, or a bond may be continuously callable, meaning the issuer may redeem the bond at the specified price at any time during the call period. Before you buy a bond, always check to see if the bond has a call provision, and consider how that might impact your investment strategy.

BOND COUPONS

A bond’s coupon is the annual interest rate paid on the issuer’s borrowed money, generally paid out semi-annually. The coupon is always tied to a bond’s face or par value, and is quoted as a percentage of “par”.

>>Example: A bond with a par value of $1,000 and an annual interest rate of 4.5 percent has a coupon rate of 4.5 percent ($45).

Many bond investors rely on a bond’s coupon as a source of income, spending the simple interest they receive.

You can also reinvest the interest, letting your interest gain interest. If the interest rate at which you reinvest your coupons is higher or lower, your total return will be more or less. Also be aware that taxes can reduce your total return.

THE POWER OF COMPOUNDING

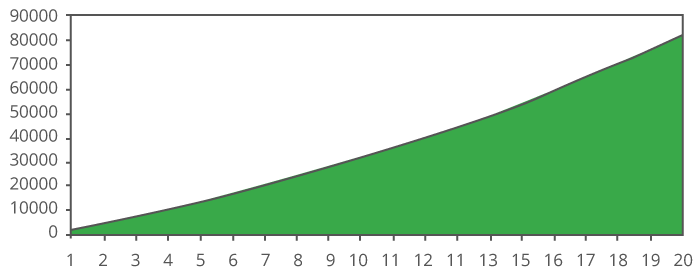

Regardless of the type of investment you select, saving regularly and reinvesting your interest income can turn even modest amounts of money into sizable investments through the remarkable power of compounding. If you save $200 a month and receive a 5 percent annual rate of return, you will have more than $82,000 in 20 years’ time.

ACCRUED INTEREST

Accrued interest is the interest that adds up (accrues) each day between coupon payments.

If you sell a bond before it matures or buy a bond in the secondary market, you most likely will catch the bond between coupon payment dates. If you’re selling, you’re entitled to the price of the bond, plus the accrued interest that the bond has earned up to the sale date. The buyer compensates you for this portion of the coupon interest, which is generally handled by adding the amount to the contract price of the bond.

BOND PRICES

Bonds are generally issued in multiples of $1,000, also known as a bond’s face or par value. But a bond’s price is subject to market forces and often fluctuates above or below par. If you sell a bond before it matures, you may not receive the full principal amount of the bond and will not receive any remaining interest payments. This is because a bond’s price is not based on the par value of the bond. Instead, the bond’s price is established in the secondary market and fluctuates. As a result, the price may be more or less than the amount of principal and the remaining interest the issuer would be required to pay you if you held the bond to maturity.

The price of a bond can be above or below its par value for many reasons, including:

> Interest rate adjustments;

> Whether a bond credit rating has changed;

> Supply and demand;

> A change in the creditworthiness of a bond’s issuer;,

> Whether the bond has been called or is likely to be (or not to be) called; or,

> A change in the prevailing market interest rates.

If a bond trades above par, it is said to trade at a premium. If a bond trades below par, it is said to trade at a discount.

>>Example: If the bond you desire to purchase has a fixed interest rate of 8 percent, and similar-quality new bonds available for sale have a fixed interest rate of 5 percent, you will likely pay more than the par amount of the bond that you intend to purchase, because you will receive more interest income than the current interest rate (5 percent) being attached to similar bonds.